PPC116 | Business

With business acquisitions at an all-time high, BPCA Operations Manager Lorraine Norton provides a simple, high-level overview of strategies to consider to get your pest business ready for sale.

“Earn out usually means you stay in the business for a period of time to deliver the profitability the buyer is looking for.”

In the current economic and political climate, it’s difficult to predict what’s around the corner but some business planning is essential if you’re thinking of selling.

When you started out in business you chose how to trade eg, sole trader or limited company, and the tax consequences would have been part of your decision-making process. When considering an exit, you’ll need to consider the tax consequences and how they can be minimised.

It’s easy to focus on the headline amount that you sell your business for, but some careful planning can make the ‘net’ number (after tax) larger without necessarily having to raise the selling price.

When is the right time to sell? What is the market value of my business? Can I afford to stop trading? A good adviser (and you should definitely have one) will be able to use software to help you get to that magic number you’d be happy to sell for. They’ll take into account other income you have, assets you could realise, ongoing living costs and big family events coming up.

There will also be post-sale tax options to consider – inheritance tax (IHT), reinvestment/recycling of sales proceeds and the tax reliefs available, as well as the use of trusts and investment planning – you may be thinking of doing it all over again!

When looking at IHT opportunities, you can minimise tax liability by giving away your wealth, but you don’t want to give away so much that you can’t afford to enjoy life in your retirement.

Different ways of exiting your business:

- Cessation of trade (sole trader/partnership)

- Liquidation (limited company ceasing to trade)

- Sale to an unconnected third party

- Succession by family members

- Succession by existing management.

Cessation of trade

Most of the goodwill value will be held personally by the business owner(s) themselves, so it can be difficult to sell on, but it isn’t uncommon.

If you simply cease trading, there are still things to consider. The date you cease trading will impact any balancing allowances/charges on your business assets and the basis period on which the business profits (or losses) are assessed.

Liquidation

Liquidating a limited company is the quickest exit route, meaning the distribution to individual shareholders will be subject to capital gains tax (CGT*) rather than income tax, ie significantly less tax payable. Your advisers can run the numbers for you.

However, there is a potential trap! Specific anti-avoidance measures prevent individuals from carrying out the same trade or business within two years of liquidation.

*CGT is a tax on the profit when you sell/dispose of something that’s increased in value.

Sale to an unconnected third party

Questions you’ll need to consider:

- Are you better off selling your shares or the assets of the business?

- Have you been offered settlement in full or some deferred consideration (earn out)? ‘Earn out’ usually means you stay in the business for a period of time to deliver the profitability the buyer is looking for. It’s riskier, as if the targets set aren’t met, then you won’t achieve maximum payout.

- If you stay in the business as a director, are there any ongoing employment issues that haven’t been dealt with?

- What exit planning should you do? You’ll want to ensure the business is structured tax efficiently for an exit and is attractive to buyers by not being overly complex. You should also undergo a tax health check.

due diligence /dʒuː/ /ˈdɪl.ɪ.dʒəns/ [ dyoo ] [ di·luh·jns ] noun, law, business. The detailed fact-gathering process for establishing a business’s assets, liabilities, commercial potential and current value.

Timing

In an ideal world, the right time to start planning for an exit is from the outset of your business. Planning as far in advance as possible is certainly advisable. For some tax reliefs to apply there are statutory timelines that you’ll need to take into account (see table 1).

Table 1: Statutory timelines

| Three years |

Employment investment scheme (EIS) |

EIS shareholders need to hold shares for three years to achieve a 0% CGT rate on sale. They also risk a clawback of income tax relief claimed on the purchase if sold within three years. |

| Two years |

Business asset disposal relief (BADR) |

Entitles founder shareholders or employee shareholders to 10% CGT rate on the first £1m if certain conditions are met for a two-year period. BADR applies to gifting or transferring shares between husband and wife. |

| One year |

Substantial shareholding exemption (SSE) |

0% CGT rate if shares are held in a subsidiary company for one year before sale. |

| Six to twelve month application process |

HMRC clearance process |

It’s often advisable to apply for HMRC clearance for pre-sale share movements, so they’re satisfied it’s for bona fide business reasons and not tax avoidance. |

Tax health check

Even if you’re a simple company, it’s still recommended that you undertake some sort of tax health check prior to a sale. This is a great time for any last minute tax planning and should identify potential risk areas or red flags that may be picked up by the buyer, which could chip away at the sale price or even damage the deal if significant.

Ensure your adviser is involved. They’re best placed to identify any tax attributes that the selling price value should take into account, eg R&D tax credits, losses available and capital allowances.

Exit through third party sale

If you’re retiring or moving on to another project, you’ll probably be selling 100% of your interest. If you want to retain an interest, be aware that a buyer will usually be looking for enough to give them control (see figure 1).

Typical issues with third party sale

There are numerous common issues that arise during sales.

There’s often a valuation gap – what you think your company is worth will rarely match the buyer’s expectations.

Many business owners are not ready for sale – their accounts are not up-to-date, or their financial systems are not robust enough to support due diligence.

Poor and/or late advice received by the seller slows things down and could mean you don’t have time to renegotiate to a more favourable price.

And then there’s the price adjustment mechanism, which sellers often forget to consider in advance but is essential for a

fair price.

The sales price is initially agreed upon based on the assumption that the business is cash-free/debt-free with a normalised level of working capital. The price adjustment mechanism adjusts the sales price for actual cash and debt levels and looks at working capital in line with typical expectations.

Succession by family/management

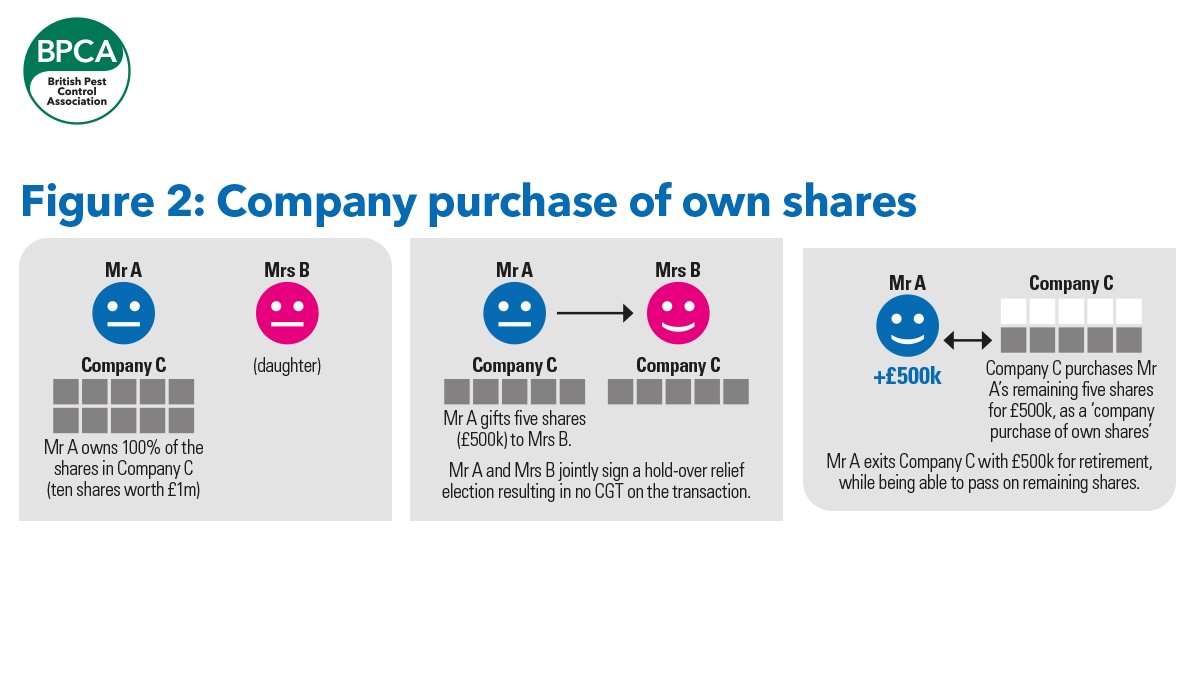

Company purchase of own shares

This typically happens when you have one shareholder coming to retirement or someone who wants to step away (could be due to a disagreement) and receive value for their shares.

If the remaining shareholder doesn’t have the finances to buy out the shares, then what can be done? Answer – the company can buy back the departing shareholder’s shares and cancel them.

The seller’s income is subject to income tax but can be subject to CGT if certain conditions are met - they must have been held in a trading company for five years and the departing shareholder must substantially reduce their shareholding.

Purchases of own shares can get clearance from HMRC in advance, which gives reassurance to the departing shareholder that they would meet the criteria for the much more favourable CGT tax route.

Gift to family

Many of you reading may have built up a business that you want to pass down to your own children. This may well be how you got into business yourself, and it is fairly common in the pest control industry.

Any transfer of shares to children will be disposed of for CGT purposes. There are no tax exemptions like there are for transfer to a spouse, but there is gift relief if you jointly (with the recipient) elect to hold over the gain until they dispose of the shares later in their own life.

Gifts are great, but it doesn’t help you realise value from those shares that may be needed to (say) fund a retirement. Instead, you could combine a ‘company purchase of own shares’ (remember the aforementioned criteria) with the gift (see figure 2).

In conclusion

If you’ve decided you’re ready to sell or pass on your pest management business to the next generation, you’ll need to consider what value you need to realise. As I’ve hopefully demonstrated, one size does not fit all!

Make sure you plan, plan and plan some more! Good advice is essential. It won’t be cheap, but if done properly, it should achieve tax savings and offer protection against bad decisions.

BPCA webinar: selling your business for maximum value

Review our guest webinar with Jonathan Barker from Kingsbrook to learn more about getting ready to sell your pest company.

bpca.org.uk/cpd-videos