PPC115 | Executive Report

The Future of Pest Management Survey was conducted to gain insights into current trends, challenges and opinions within the pest management industry. The survey covered various aspects including tools and techniques used, experiences with control methods, thoughts on future challenges and considerations regarding sustainability.

816 UK pest professionals responded to the survey. They included business leaders and technicians from both BPCA member and non-member companies. 84% of participants had a Level 2 Award in Pest Management qualification (or above).

Non-chemical toolkit and techniques

Break-back traps are utilised most frequently, with 76% of respondents indicating their widespread use in the industry.

Non-chemical rodent control traps ranked by common usage are:

- Break-back (snap) traps

- Spring traps

- Live capture

- Digitally enabled trapping devices

- Electric/electrocution devices

- Gas-powered traps.

In the case of traps, 63% of participants routinely bait them with lures. Notably, 77% of professionals modify the lure during deployment, highlighting a strategic approach to sustaining their effectiveness over time.

Crucially, only 58% of participants agreed that using traps works better than other control methods. 59% agreed that there are situations where traps do not work well.

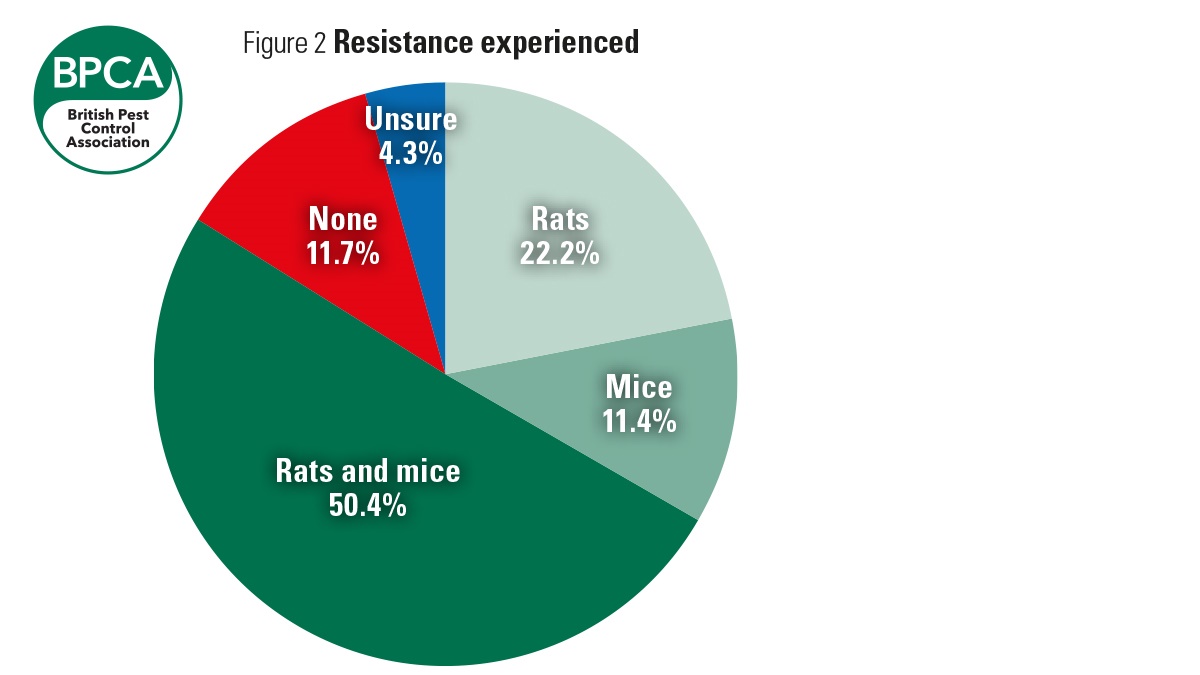

Pest professionals indicated that traps alone do not reliably eliminate a long-term infestation, particularly in commercial settings, such as food factories (see figure 1). This clearly suggests that a trap-only pest management toolkit would not be appropriate for professional pest management in the UK.

Interestingly, pest professionals favour making only approved and regulated traps available for rodent control with 68% of participants calling for tighter control.

Respondents expressed mixed views on the ability of traps alone to reliably eliminate long-term infestations, with 12% occasionally finding rodents alive in break-back traps. 65% stated that bans on glue boards would impact their ability to control rodent infestations, with 20% anticipating a significant impact.

Additionally, 63% believed glue boards are the best solution in certain circumstances, often as a last resort. This shows that glue boards are crucial in specific scenarios where other methods might be less effective.

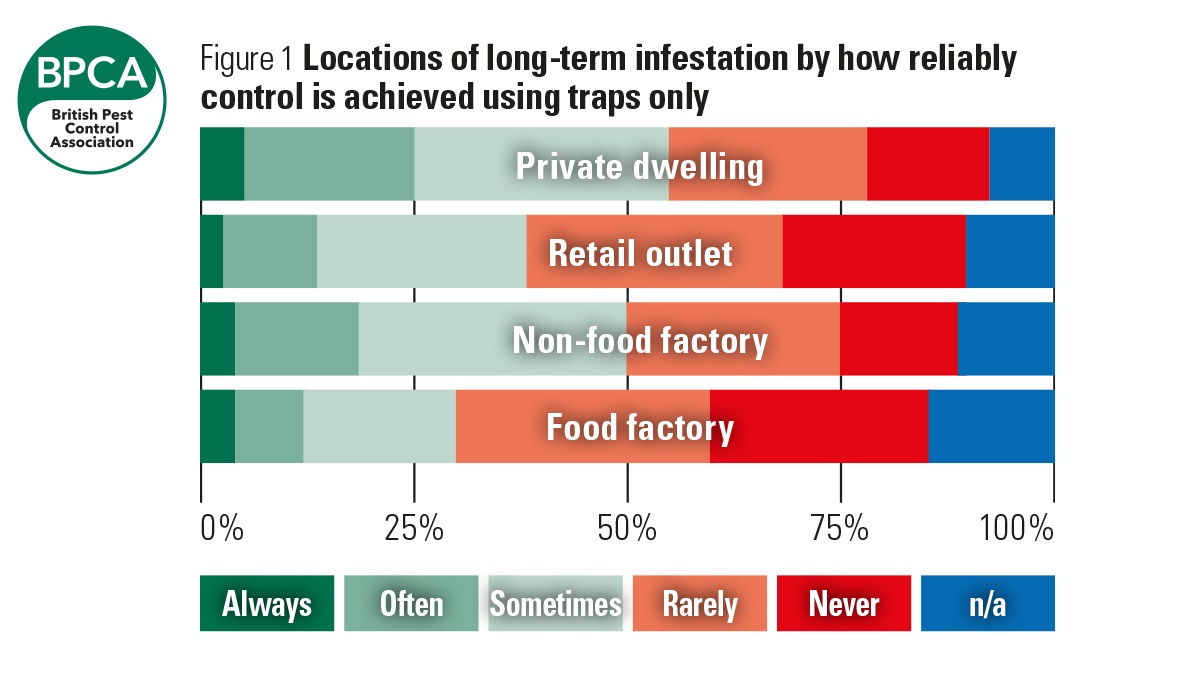

Biological resistance was reported by 59% of respondents with 84% experiencing rodent behavioural resistance (see figure 2).

Monitoring

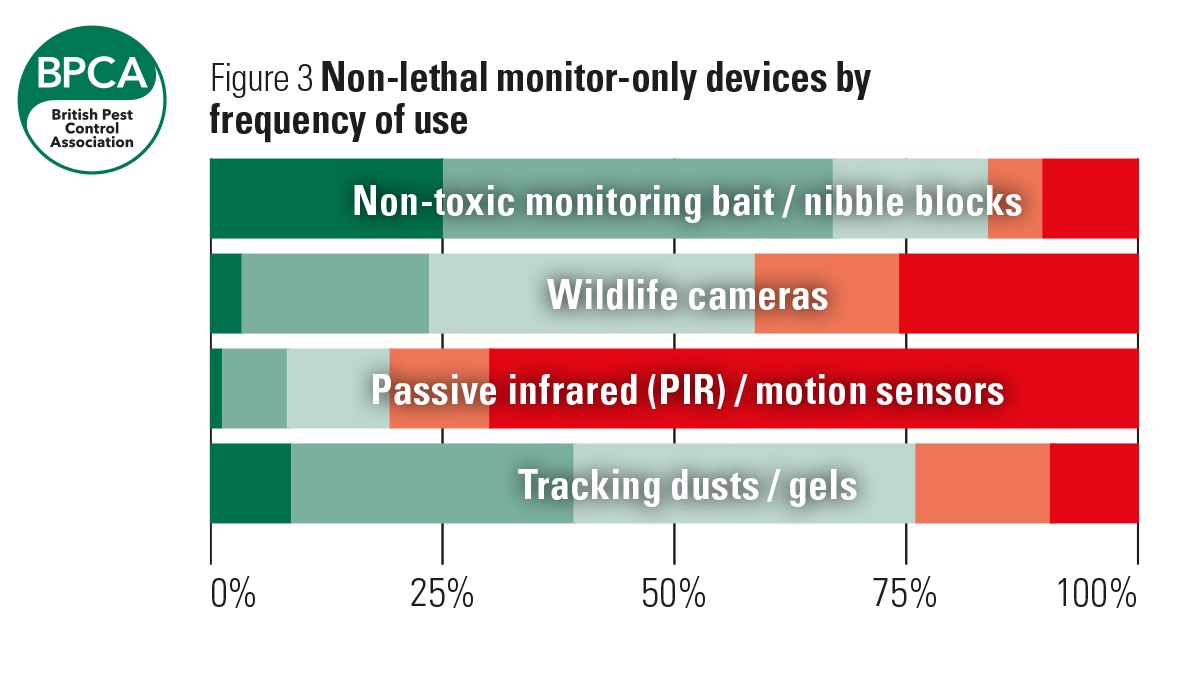

Pest professionals continue to use an array of monitoring devices for rodent treatment, and we can see a trend towards increased use of technology such as wildlife cameras (74% of participants have tried them – see figure 3).

A significant portion (89%) reported experiencing control failure due to suspected trap avoidance with neophobia identified as a contributing factor. Furthermore, 90.89% encountered triggered traps without an obvious cause. This raises concerns about potential malfunctions or unidentified factors affecting trap functionality.

These findings suggest that, while break-back traps and bait traps with lures are widely used and preferred by pest professionals, there are challenges related to trap avoidance and unexplained failures.

The identified factors, such as neophobia and triggers without apparent causes, emphasise the need for ongoing research and innovation in trap design and deployment strategies to enhance the overall effectiveness of pest control efforts in the industry.

Control strategies – rodenticides

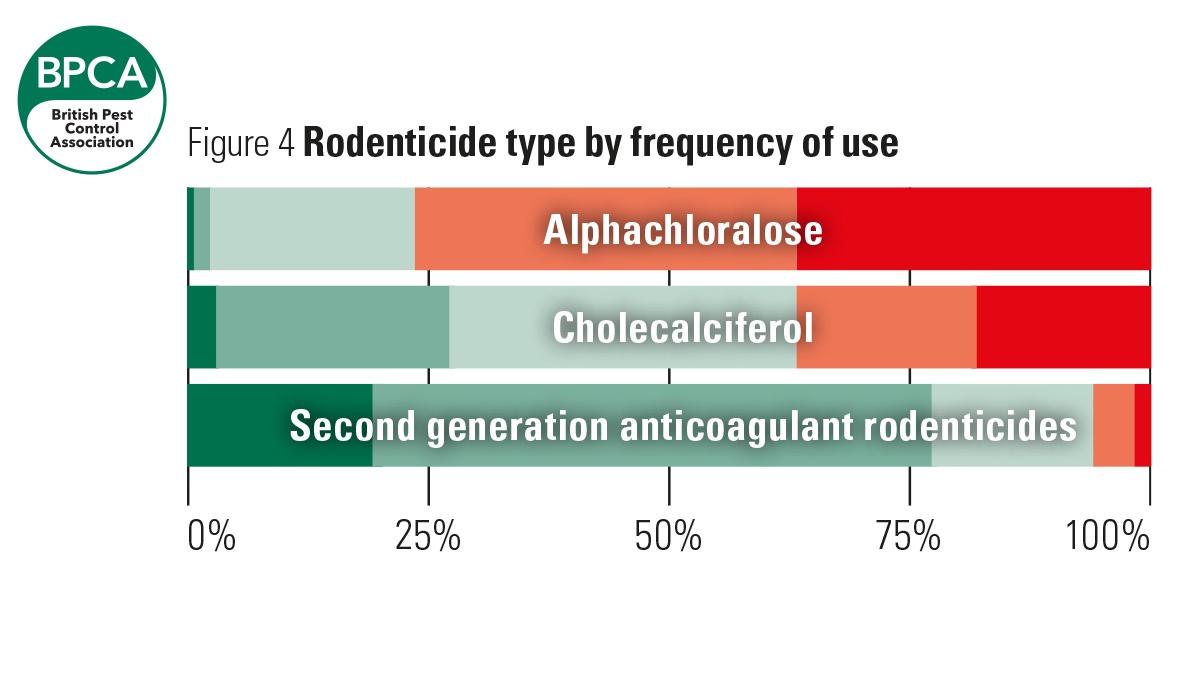

As expected, second generation anticoagulant rodenticides (SGARs) continue to be the most popular chemical tool available for pest professionals, with 77% of participants saying they used them often or always (see figure 4).

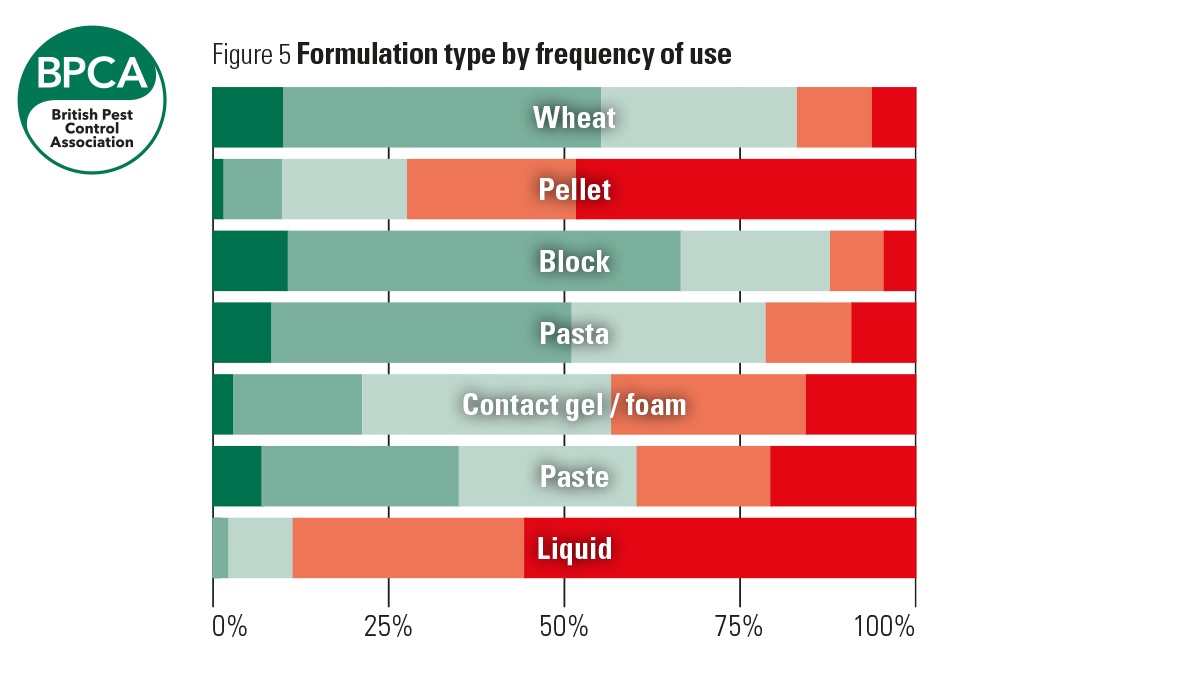

In terms of formulation, block, wheat and pasta baits continue to be the most used (see figure 5).

70% of participants believe anticoagulant rodenticides are more palatable than cholecalciferol (22%) and alphachloralose (7%) baits.

41% of respondents reported experiencing biological resistance. Respondents commonly addressed biological resistance by adopting strategies such as swapping active ingredients and transitioning to physical control methods. This suggests a proactive approach to managing resistance issues within the industry.

Industry trends

A noteworthy majority (89%) of respondents believe that rodent control will become harder in the next five years. More than half (53%) anticipate that it will be much harder, signalling a perception of increasing challenges in the field of pest management.

A significant percentage supported increased regulation, licensing for pest professionals and tighter restrictions on sellers. Most respondents believed pest professionals should be licensed (92%) and supported various measures to ensure competence and accountability. A significant minority believe that, while they’re in favour of licensing, they don’t believe now is the time to push for licensing (11%), suggesting we may still have work to do regarding training, qualifications and competency before we push for a formal licensing scheme.

Trainings and qualifications

97% of respondents had pest management qualifications, with 84% having RSPH Level 2 Award/Certificate in Pest Management equivalent or higher.

44% are responsible for the recruitment or management of pest professionals.

66% would support career progression via an apprenticeship scheme if funding were available to support it. Respondents recognise the value of such programs; however, concerns were raised regarding the financial implications, particularly concerning vehicle insurance for apprentices. This highlights a practical challenge that organisations may face in implementing apprenticeship schemes.

Sustainability

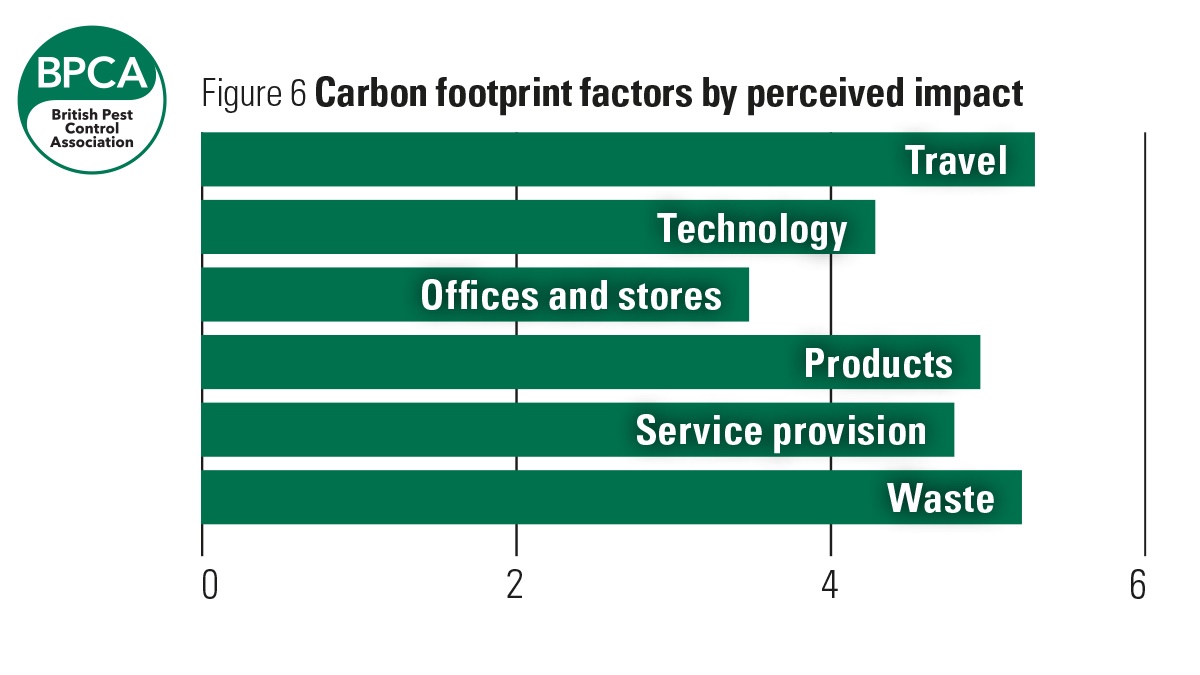

Respondents expressed concerns about the industry’s carbon footprint, giving an average rating of 5.27 (see figure 6).

Most common suggestions for lowering carbon footprints were:

- Compact service area and better route planning

- Recyclable packaging from manufacturers

- Reduce waste and implement better waste management.

Respondents’ broad opinion is that lowering the pest management industry’s carbon footprint is the responsibility of manufacturers or employers.

Final thoughts

The survey offers comprehensive insights into the pest management industry’s current landscape, revealing strengths, vulnerabilities, and proactive strategies.

Notably, the industry’s proactive approach to addressing resistance issues, such as swapping active ingredients and transitioning to physical control methods, highlights a commitment to adaptability and resilience.

Anticipated difficulties in rodent control over the next five years underscore the need for continuous evolution. Concerns about glue board bans and biological or behavioural resistance emphasise the call for increased BPCA lobbying and research.

Additionally, regulatory support for licensing reflects a collective commitment to competence and accountability.

In conclusion, the survey provides a snapshot and outlines key areas for improvement, emphasising collaboration, innovation, and sustainability in pest management practices.

These findings have already proved useful in helping to protect our toolkit, with the data being cited in the Scottish Parliament regarding the proposed glue board ban.

Our Academic Relations Working Group is still analysing the data, and we’re likely to have more articles based on this research available in PPC.

What’s next?

If you’re interested in this research project, get involved with the BPCA Academic Working Group. Register your interest:

technical@bpca.org.uk